1.Individuals

LITO

Background

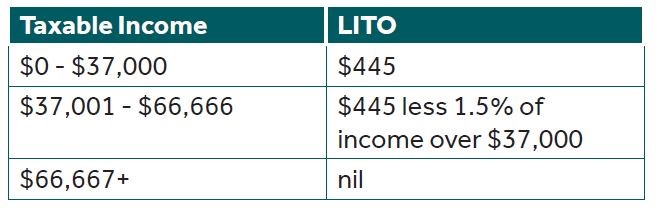

The low income tax offset is a non-refundable rebate that reduces the tax payable of eligible individuals whose income falls below $66,667 in an income year. Bear in mind that this rebate simply decreases your tax payable, and is not refunded if no tax was withheld for you by the employer.

Announcement

The table below illustrates the LITO rates that is applicable now and the 2021-22 income year:

In the 2018 Federal Budget, the Government announced that from 1 July 2022, LITO & the temporary LMITO rebates will be exchanged by a single LITO, following the removal of the LMITO from that same year. This single LITO will increase by $200, to a maximum of $645.

A further increase to the maximum amount up to $700 was announced in the 2019-20 Federal Budget, from the year ending 30 June 2023, as illustrated in the table below:

LMITO

Background

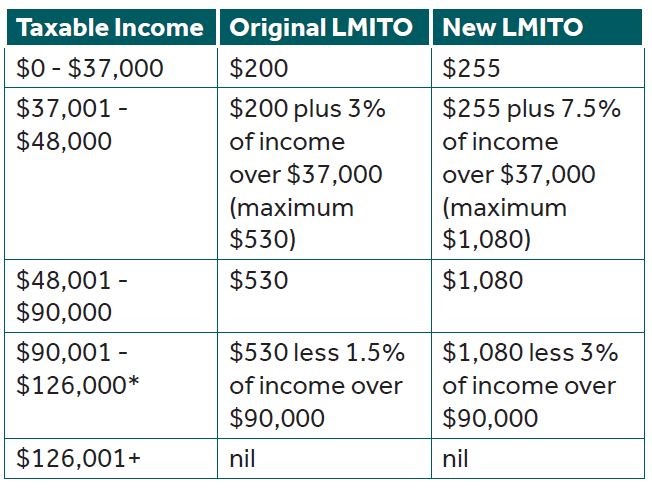

Low-and-middle-income-tax-offset (LMITO) which was announced in the 2018 Federal Budget is very similar to LITO, in that it also is a non-refundable rebate that provides further tax cut for low & middle income earners. The difference lies in LMITO being a temporary relief until the 2021-22 income year.

Announcement

The 2019 Federal Budget has announced an increase to the maximum rebate amount from $530 to $1,080 per annum, along with the base amount from $200 to $255 per annum. This rebate will be available for taxpayers upon lodging their 2019 individual tax returns. The table below illustrates the LMITO rebates for the different income threshold:

So for a taxpayer who earns $50,000 for the 2018-19 income year, they will receive the full LMITO rebate of $1,080, plus the partial LITO rebate as shown on the first table of illustration.

Marginal Tax Rates

Background

Currently, the thresholds for personal income tax rates are shown below:

(Note that these rates do not include the 2% Medicare levy)

Announcement

The Government announced that with the removal of the temporary LMITO rebate in 2022-23, the top threshold for the 19% tax rate will increase from $41,000 to $45,000. Additionally, the 32.5% marginal tax rate will reduce to 30% from 2024-25.

The table below illustrates the new tax rates:

From 2024-25, it is estimated that around 94% of taxpayers will be in the 30% marginal tax rate (plus 2% Medicare levy) or less.

Medicare Levy

Background

Medicare levy is imposed on Australian residents at a rate of 2% in addition to the tax rate for access to the public health care. Depending on the taxpayer’s income threshold, there may be a reduction or exemption from paying this levy.

Announcement

The income thresholds for all taxpayers will increase from the 2018-19 income year to take account of recent CPI (Consumer Price Index) movements.

The table below shows the 2018-19 income threshold where no Medicare levy will be imposed:

Proposed removal of capital gains tax (‘CGT’) exemption for foreign resident’s family homes

Background

In the 2017-18 Federal Budget, the Government announced that family homes would lose its tax-exempt status upon your becoming a foreign resident. This was widely viewed as being harsh, as it would retrospectively deny the CGT exemption.

Announcement

No announcement on the proposed changes was made in the 2019-20 Federal Budget.

2.Businesses

Instant asset write-off increase to $30,000

Background

Currently, businesses with group-wide turnover below $10 million can fully deduct the cost of most depreciable assets that cost less than $20,000. Any depreciable assets costing $20,000 or more are deducted over several years. The cost threshold for the instant deduction was due to return to the standard $1,000 on 1 July 2019.

Announcement

For depreciable assets acquired after 2 April 2019, the threshold will increase to $30,000, and the write-off will be available for a further 12 months to 30 June 2020. Additionally, this write-off will now extend to businesses with a turnover from $10 million to $50 million.

Amendments to Division 7A Private Company Loan Rules

Background

Companies pay tax at 27.5% or 30%, whereas shareholders may pay tax at higher personal rates. Division 7A is an anti-tax avoidance regime to prevent shareholders from accessing company profits in a manner that is not included in assessable income – usually by way of a loan – without paying the difference between the company tax rate and the shareholders’ personal tax rate. Breaching Division 7A usually triggers a deemed assessable dividend to the shareholder or related party.

Announcement

A number of long-awaited amendments to Division 7A were proposed to start on 1 July 2019, as well as other possible amendments arising from a Treasury Consultation Paper released in October 2018. Proposed changes included:

- Simplified loan repayment terms;

- Self-correction mechanism to rectify breaches;

- Legislating to bring trust unpaid present entitlements (UPE) into Division 7A;

- Replacing both the 7-year and 25-year loan terms with a standard 10-year maximum term;

- Abolishing the distributable surplus limit on the amount of a deemed dividend; and

- Bringing grandfathered pre-1997 loans into Division 7A.

The start date for any changes to Division 7A will be delayed a further 12 months to 1 July 2020. The Government and Treasury will use this time to consult with the community to improve the proposed amendments.

Increased funding for the Export Market Development Grant (‘EDGM’) scheme

Background

The EMDG scheme is an assistance program developed by the Federal Government that aims to support businesses develop export markets through marketing and promotional activities. Through this scheme, applicants who satisfy the conditions are reimbursed up to 50% of eligible export promotion expenses.

Announcement

The Government will invest a further $60 million in the EMDG scheme over the next three years. By way of comparison, the EMDG scheme made grants totaling $131.6 million to qualifying exporters in the 2017-18 year.

The increased funding is intended to help businesses obtain more exposure in international markets and generate additional exports for Australia.

Increased refunds of Luxury Car Tax for primary producers and tourism operators

Background

Currently, eligible primary producers and tourism operators may be eligible for a partial refund of the Luxury Car Tax paid on eligible four-wheel or all-wheel drive cars, up to a maximum of $3,000.

Announcement

For vehicles acquired on or after 1 July 2019, eligible primary producers and tourism operators will be able to apply for a refund of any Luxury Car Tax paid, up to a maximum of $10,000. The eligibility criteria for primary producers and tourism operators and the types of vehicles eligible for the concession will remain unchanged.

Black Economy – strengthening the Australian Business Number (‘ABN’) system

Background

Current ABN holders are able to retain their ABN even where they are not complying with income tax return lodgement obligations and/or the obligation to update their ABN details.

Announcement

As part of the conditions for holding an ABN, ABN holders with an income tax return obligation will be required, from 1 July 2021, to lodge their income tax return and, from 1 July 2022, to confirm the accuracy of their details on the Australian Business Register annually. The ABN holder may lose their ABN if they fail to comply with these two measures.

This measure is expected to disrupt black economy behaviour, as it is required by law for customers to withhold 47% of their payment to businesses that do not quote their ABN.

Tax Avoidance Taskforce funding boost

Announcement

The Government will provide $1 billion to extend the ATO taskforce’s compliance activities targeting multinationals, large public and private groups, trusts and high-wealth individuals. Additional funding will also be provided to the ATO and Treasury to increase their capabilities to analyze taxpayer data.

The authority’s increased ability to cross-match vast amounts of data to uncover anomalies may increase the risk of ATO review or audit. The integrity and consistency of information provided for accounting has become ever more important.

3.Superannuation

Insurance for Members of Superannuation Funds with Low Balances

Background

Superannuation funds have been required to offer insurance for members. Last month, a law was passed to ensure that superannuation fund trustees stop providing insurance on an opt-out basis from 1 July 2019 to members whose member account has been inactive for longer than 16 months, unless the member requests the insurance to continue.

Announcement

In contrast, insurance will be offered only on an opt-in basis where member balances are less than $6,000 and where the new member is less than 25 years of age. The start date for this measure has been extended from 1 July 2019 to 1 October 2019.

Increased Budget for ATO Compliance Activities

Announcement

The Government will provide an additional $42.1 million to the ATO over four years to increase compliance activity directed at recovering unpaid tax and superannuation liabilities. The focus of these activities is ensuring on-time payment of tax and superannuation liabilities by larger businesses and high wealth individuals, but not at small businesses.

4.International

Updating the List of Information Exchange Countries

Background

The tax legislation lists countries that have entered into an effective information sharing agreement with Australia, in order to combat offshore tax avoidance and evasion. Residents of listed countries are able to access a reduced withholding tax rate of 15%, instead of the default rate of 30%, on certain distributions from Australian Managed Investment Trusts.

Announcement

The list of information exchange countries will be updated to include Curaçao, Lebanon, Nauru, Pakistan, Panama, Peru, Qatar and the United Arab Emirates, effective from 1 January 2020.