Individuals

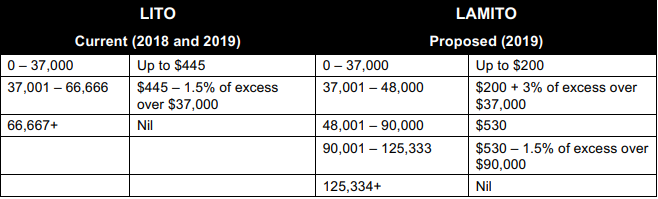

- Low and Middle Income Tax Offset up to $530 will be introduced for the 2019 to 2022 income years.

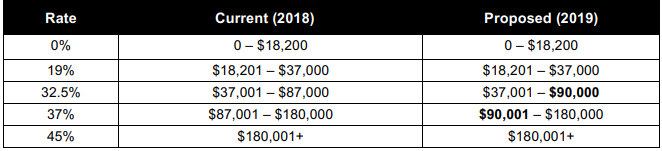

- From 1 July 2018, the threshold at which the 32.5% marginal tax rate for individuals will increase from taxable incomes of $87,000 to $90,000.

- The 37% tax bracket will be removed from 1 July 2024. The 32.5% tax bracket will apply to taxable incomes of $41,001 to $200,000 and taxpayers with taxable incomes exceeding $200,000 will pay tax at the top marginal rate of 45%.

- The previously announced increase in the Medicare levy to 2.5% from 1 July 2019 will not proceed, and the levy will remain at 2% of taxable income.

SMEs

- From 1 July 2018, the turnover threshold to be eligible for the small business concessions will be extended from $25m to $50m.

- The $20,000 immediate write-off for small business has been extended for further 12 months to 30 June 2019.

Superannuation

- From 1 July 2019, the Government will increase the maximum number of allowable members in new and existing SMSFS and small APRA funds from four to six.

- Insurance within superannuation will move from a default framework to an opt-in basis for: members with low balances of less than $6,000; members under the age of 25 years; and members whose accounts have not received a contribution in 13 months and are inactive.

- Funds with balances less than $6,000 will be protected with a 3% annual administration fees cap.

Businesses

- From 1 July 2019, the Taxable payments reporting system (TPRS) will be expanded to the following industries:

- Security providers and investigation services;

- Road freight transport; and

- Computer system design and related services.

The TPRS already operates in the building and construction industry, expanding to courier and cleaning industries from 1 July 2018.

- From 1 July 2019, the cash payments more than $10,000 made to businesses for goods and services will be banned. Transactions over $10,000 will have to be made through an electronic payment system or cheque. Transactions with financial institutions or consumer to consumer non-business transactions will not be affected.

- From 1 July 2019, businesses will no longer be able to claim deductions for payments to their employees where they have not withheld the required PAYG.

- Claiming deductions for payments made contractors where the contractor does not provide an ABN and the business does not withhold PAYG will be also disallowed.

- From 1 July 2019 owners with vacant land will not be entitled to deductions associated with holding the vacant land where the owner do not intends to produce assessable income. This includes interest costs and council rates. This measure does not apply to land to carry out a business, including the business of primary production.