The end of the financial year is fast approaching. The following is a list of some of the issues you may wish to consider.

Small Business Tax Saving Strategies

In order to minimise liability to taxation for the current year, the general strategy options for most taxpayers are as follows:

- Delay deriving assessable income;

- Pay wages before 30 June;

- Make superannuation contribution payments for the June quarter before 30 June (It is safe to pay the super contributions to the Super Clearing Account by 23 June to allow processing time for the employees’ super funds to receive the payments by 30 June);

- Consider instant asset write off for assets purchased during the financial year;

- Pre-pay expenses before they are due (e.g. Insurance premiums, membership of organisations, travel, advertising and interest);

- Bring forward repairs and maintenance by 30 June;

- Write off bad debts;

- Make donations – donations of $2 or more to a deductible gift recipient are tax deductible.

Business Checklist

- Finalisation of Single Touch Payroll by 14 July;

- Preparation of Taxable Payment Annual Report (building and construction services, cleaning services, courier services, security services & IT services only);

- Preparation of Stock Take Report as at 30 June;

- If you use a car in producing your income you may need to:

- Record Motor Vehicle Odometer readings at 30 June;

- Prepare a 12 week log book if your existing one is older than 5 years.

- If your Directors Loan Account in your business in debit, you must either:

- Fully repay the loan before the earlier of the due date for lodgment and the date of the lodgment of the lender’s tax return for the year of income or

- Have Division 7A loan agreement in place.

Temporary Full Expensing

Temporary full expensing measure allows companies to deduct the full cost of eligible depreciable assets of any value acquired between 7.30pm AEDT on 6 October 2020 and 30 June 2023.

Please be aware that a car limit applies to the cost of passenger vehicles designed to carry a load less than one tonne and fewer than 9 passengers. The car limit is $59,136 for the 2020-21 year. You cannot claim the excess cost over the car limit.

Temporary Tax Loss Carry-back

Eligible companies incurring tax losses for the 2019-20, 2020-21, 2021-22- or 2022-23-income years could carry them back to offset tax paid in the 2018-19 or later income years. Tax refunds resulting from loss carry back will be available to companies when they lodge their tax returns.

If companies do not elect to carry back tax losses, the losses can still be carried forward as normal.

Expanding Single Touch Payroll

From 1 July 2021, STP quarterly reporting concession for Micro Employers (1-4 employees) will end. Employers will need to report payments to employees, using a Single Touch Payroll software, to the ATO when the payments occur, instead of reporting quarterly.

From 1 July 2021, employers who only have closely held employees will also need to report their closely held employee wages through STP. They can choose to report these payees each pay day, monthly or quarterly.

Changes to Company Tax Rates

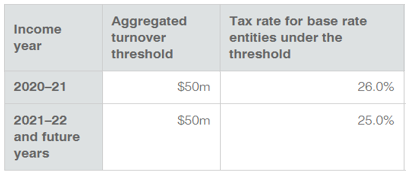

The table below illustrates the company tax rates for small business.

The lower company tax rate will reduce to 25% from the 2021–22 and future income year.

Family Trust

If you are a trustee and you make beneficiaries of a trust entitled to trust income by way of a resolution:

- The trustees must make the resolution and have evidence of this by 30 June at the latest;

- The trustee must lodge a TFN report with the ATO by the last day of the month following the end of the quarter where the distribution is either paid or resolved to be paid to a new beneficiary for the trust.

Compulsory Superannuation Guarantee

The SG rate is currently legislated to increase from 9.5% to 10% from 1 July 2021, and by 0.5% per year from 1 July 2022 until it reaches 12% from 1 July 2025.

The Superannuation Guarantee $450 per month eligibility threshold will be removed from 1 July 2022. As a result, employers will be required to make quarterly Super Guarantee contributions on behalf of such low-income employees earning less than $450 per month.

Personal Super Contribution

From 1 July 2017, most people, regardless of their employment arrangement, will be able to claim a full deduction for personal super contributions they make to their super until they turn 75.

You may be eligible to claim a tax deduction for your personal super contributions up to $25,000. If you wish to claim a tax deduction for personal contributions, you must complete and lodge a ‘Notice of intention to claim a tax deduction’ with your super fund and have this notice acknowledged (in writing) by your fund.

Please note that the contributions that you claim as a deduction will count towards your concessional contributions cap ($25,000, including superannuation guarantee, additional employer contributions and any salary sacrificed contributions). If you exceed your cap, you will have to pay extra tax and any excess concessional contributions will count towards your non-concessional contributions cap.

However, your cap may be higher if you did not use the full amount of your cap in earlier years. This is called the carry-forward of unused concessional contributions. You can check your available concessional contributions cap on ATO online services (accessed via myGov).

The concessional contributions cap is set to increase to $27,500 for the 2021-22 financial year.

Super Co-contribution

If you’re a low or middle-income earner (with taxable income less than $54,837 for 2020-21FY) and make personal (after-tax) contributions to your super fund, the government also makes a contribution based on 50% of your contributions up to a maximum amount of $500.