BOOSTING CASH FLOW FOR EMPLOYERS

Summary

Employers will receive a payment equal to 100 per cent of their PAYG withheld (up from 50 per cent), with the maximum payment being increased from $25,000 to $50,000. In addition, the minimum payment is being increased from $2,000 to $10,000.

An additional payment is also being introduced up to September 2020 period. Eligible entities will receive an additional payment equal to the total of all of the Boosting Cash Flow for Employers payments they have received. This means that eligible entities will receive at least $20,000 up to a total of $100,000 under both payments. The cash flow boost provides a tax free payment to employers and is automatically calculated by the Australian Taxation Office (ATO). There are no new forms required.

Eligibility – Boosting Cash Flow for Employers payments

Small and medium sized business entities and NFPs with aggregated annual turnover under $50 million and that employ workers will be eligible. Eligibility will generally be based on prior year turnover. The payments will only be available to active eligible employers established prior to 12 March 2020. However, charities which are registered with the Australian Charities and Not-for-profits Commission will be eligible regardless of when they were registered, subject to meeting other eligibility requirements.

- The payment will be delivered by the ATO as an automatic credit in the activity statement system from 28 April 2020 upon employers lodging eligible upcoming activity statements.

- Eligible employers that withhold tax to the ATO on their employees’ salary and wages will receive a payment equal to 100 per cent of the amount withheld, up to a maximum payment of $50,000.

- Eligible employers that pay salary and wages will receive a minimum payment of $10,000, even if they are not required to withhold tax.

Eligibility – Additional payment

To qualify for the additional payment, the entity must continue to be active.

For monthly activity statement lodgers, the additional payments will be delivered as an automatic credit in the activity statement system. This will be equal to a quarter of their total initial Boosting Cash Flow for Employers payment following the lodgment of their June 2020, July 2020, August 2020 and September 2020 activity statements (up to a total of $50,000).

For quarterly activity statement lodgers the additional payments will be delivered as an automatic credit in the activity statement system. This will be equal to half of their total initial Boosting Cash Flow for Employers payment following the lodgment of their June 2020 and September 2020 activity statements (up to a total of $50,000).

*Specific integrity rule: designed to stamp out artificial or contrived arrangements that are implemented to obtain access to this measure. If an employer or an associate enters into a scheme with the sole or dominant purpose of obtaining or increasing any of the above payments, the employer will not be eligible for any such payments.

Example 1

Sarah owns and runs a building business in South Australia and employs 8 construction workers on average full-time weekly earnings, who each earn $89,730 per year. Sarah reports withholding of $15,008 for her employees on each of her monthly Business Activity Statements (BAS). Under the Government’s changes, Sarah will be eligible to receive the payment on lodgment of her BAS. Sarah’s business receives:

- A credit of $45,024 for the March period, equal to 300 per cent of her total withholding.

- A credit of $4,976 for the April period, before she reaches the $50,000 cap.

- No payment for the May period, as she has now reached the $50,000 cap.

- An additional payment of $12,500 for the June period, equal to 25 per cent of her total Boosting Cash Flow for Employers payments.

- An additional payment of $12,500 for the July period, equal to 25 per cent of her total Boosting Cash Flow for Employers payments.

- An additional payment of $12,500 for the August period, equal to 25 per cent of her total Boosting Cash Flow for Employers payments.

- An additional payment of $12,500 for the September period, equal to 25 per cent of her total Boosting Cash Flow for Employers payments.

Under the Government’s enhanced Boosting Cash Flow for Employers measure, Sarah’s business will receive $100,000.

Example 2

Tim owns and runs a small paper delivery business in Melbourne, and employs two casual employees who each earn $10,000 per year. In his quarterly BAS, Tim reports withholding of $0 for his employees as they are under the tax-free threshold. Under the Government’s changes, Tim will be eligible to receive the payment on lodgment of his BAS. Tim’s business will receive:

- A credit of $10,000 for the March quarter, as he pays salary and wages but is not required to withhold tax.

- An additional payment of $5,000 for the June quarter, equal to 50 per cent of his total Boosting Cash Flow for Employers payments.

- An additional payment of $5,000 for the September quarter, equal to 50 per cent of his total Boosting Cash Flow for Employers payments.

If Tim begins withholding tax for the June quarter, he would need to withhold more than $10,000 before he receives any additional payment.

Under the Government’s enhanced Boosting Cash Flow for Employers measure, Tim’s business will receive $20,000.

CORONAVIRUS SME GUARANTEE SCHEME

Summary

The Government will provide a guarantee of 50 per cent to SME lenders for new unsecured loans to be used for working capital. This will enhance these lenders’ willingness and ability to provide credit, which will result in SMEs being able to access additional funding to help support them through the upcoming months.

Eligibility

SMEs with a turnover of up to $50 million will be eligible to receive these loans.

The Government will provide eligible lenders with a guarantee for loans with the following terms:

- Maximum total size of loans of $250,000 per borrower

- The loans will be up to three years, with an initial six month repayment holiday

- The loans will be in the form of unsecured finance, meaning that borrowers will not have to provide an asset as security for the loan

Loans will be subject to lenders’ credit assessment processes with the expectation that lenders will look through the cycle to sensibly take into account the uncertainty of the current economic conditions.

The Scheme will commence by early April 2020 and be available for new loans made by participating lenders until 30 September 2020

INCOME SUPPORT FOR INDIVIDUALS

Summary

The Government is temporarily expanding eligibility to income support payments and establishing a new, time-limited Coronavirus supplement to be paid at a rate of $550 per fortnight. This supplement will be paid to both existing and new recipients of the eligible payment categories. These changes will apply for the next six months.

HOUSEHOLDS SUPPORT PAYMENTS

Summary

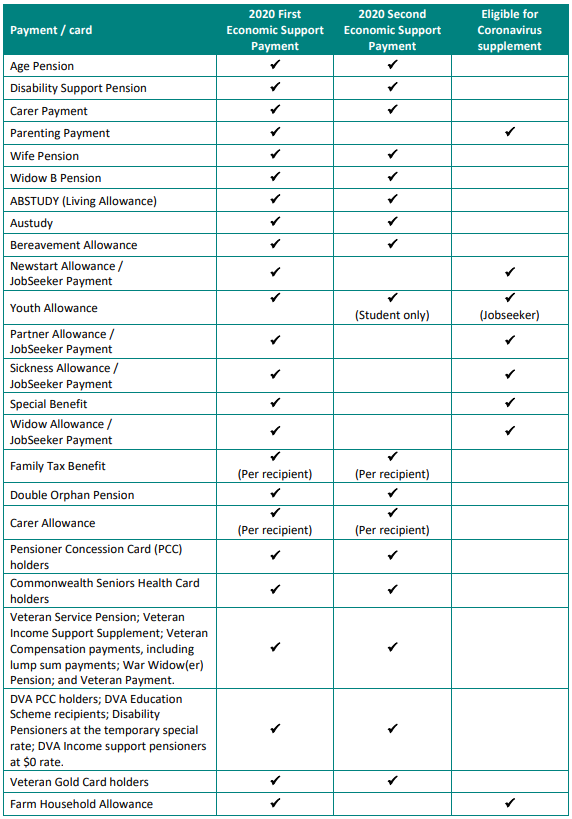

The Government is providing two separate $750 payments to social security, veteran and other income support recipients and eligible concession card holders.

- The first payment (announced on 12 March 2020) will be available to people who are eligible payment recipients and concession card holders at any time from 12 March 2020 to 13 April 2020 inclusive. This payment will be made automatically to eligible individuals from 31 March 2020.

- The second payment will be available to people who are eligible payment recipients and concession card holders on 10 July 2020. This payment will be made automatically to eligible individuals from 13 July 2020.

A person can be eligible to receive both a first and second support payment. However, they can only receive one $750 payment in each round of payments, even if they qualify in each round of the payments in multiple ways. The payment will be exempt from taxation and will not count as income for the purposes of Social Security, Farm Household Allowance and Veteran payments.

Eligibility

Payment categories the income support and households support payment categories eligible to receive the Coronavirus supplement can be found in the table below:

EARLY ACCESS TO SUPERANNUATION

Summary

Eligible individuals will be able to apply online through myGov to access up to $10,000 of their superannuation before 1 July 2020. They will also be able to access up to a further $10,000 from 1 July 2020 for approximately three months (exact timing will depend on the passage of the relevant legislation).

Eligibility

To apply for early release you must satisfy any one or more of the following requirements:

- you are unemployed; or

- you are eligible to receive a job seeker payment, youth allowance for jobseekers, parenting payment (which includes the single and partnered payments), special benefit or farm household allowance; or

- on or after 1 January 2020:

- you were made redundant; or

- your working hours were reduced by 20 per cent or more; or

- if you are a sole trader — your business was suspended or there was a reduction in your turnover of 20 per cent or more.

People accessing their superannuation will not need to pay tax on amounts released and the money they withdraw will not affect Centrelink or Veterans’ Affairs payments.

Please note the above measures are subject to the relevant legislation passing through the parliament.

To date, $189 billion has been thrown to stop the economic fallout of the conronavirus crisis. We really hope that the effort will help build a bridge to recovery.

We are going through unprecedented times and we thank you for your continued support in this period of uncertainty. Rest assured that we are doing whatever it takes to bring you the same service and reviewing our internal procedures to overcome the significant challenges presented by the cononavirus.

Please look after each other and your family.

Samuel Yang CA CPA

Registered Tax Agent